Bored Apes, Meet Punks: Thoughts On The Largest NFT Acquisition Yet 🙈 🤖 🎢

Does this mean that punks will be bored now too?

Join the creators, students, early career professionals, founders, executives, and more focused on learning and empowering each other on web3 concepts by subscribing below.

My goal is to bring diverse minds together to accelerate our web3 education to build a better future. My hope is that these recaps will be in service of that objective.

Here’s today’s roadmap

Today we are discussing the recent acquisition from Yuga Labs. They are the parent company of the Bored Ape Yacht Club, the second most valuable NFT collection. The most valuable collection is the Cryptopunks, owned by Larva Labs. Last week, Yuga Labs acquired the rights to Cryptopunks from Larva Labs, bringing the two largest collections into one.

The implications of this move are still being ironed out. Below I’ll provide some early thoughts. Here’s what we will discuss:

Context on Yuga Labs & Larva Labs

Following Disney’s Playbook

OpenSea Faces Competition

Centralization of Power

Let’s begin.

Context

Yuga Labs, the creator of the Bored Ape Yacht Club, acquired Cryptopunks and Meebits last week from Larva Labs. Here’s insight on how big this is:

Cryptopunks were the first NFT collection created in 2017. There have been ~750k Ethereum spent on Cryptopunks since - $2B USD in today’s prices (source)

Yuga Labs has generated $2B in sales with $140M of profit since launching in April ‘21 (source)

With this acquisition, Yuga Labs now owns the brand, copyright in the art, and the IP rights for both collections. The financial terms were undisclosed. This is a unique example of an upstart quickly gaining market share, approaching the market value of their closest competitor, then acquiring it. Finding comparisons of a similar deal outside of web3 has been difficult to conjure.

How will this impact the ecosystem moving forward?

Following Disney’s Playbook

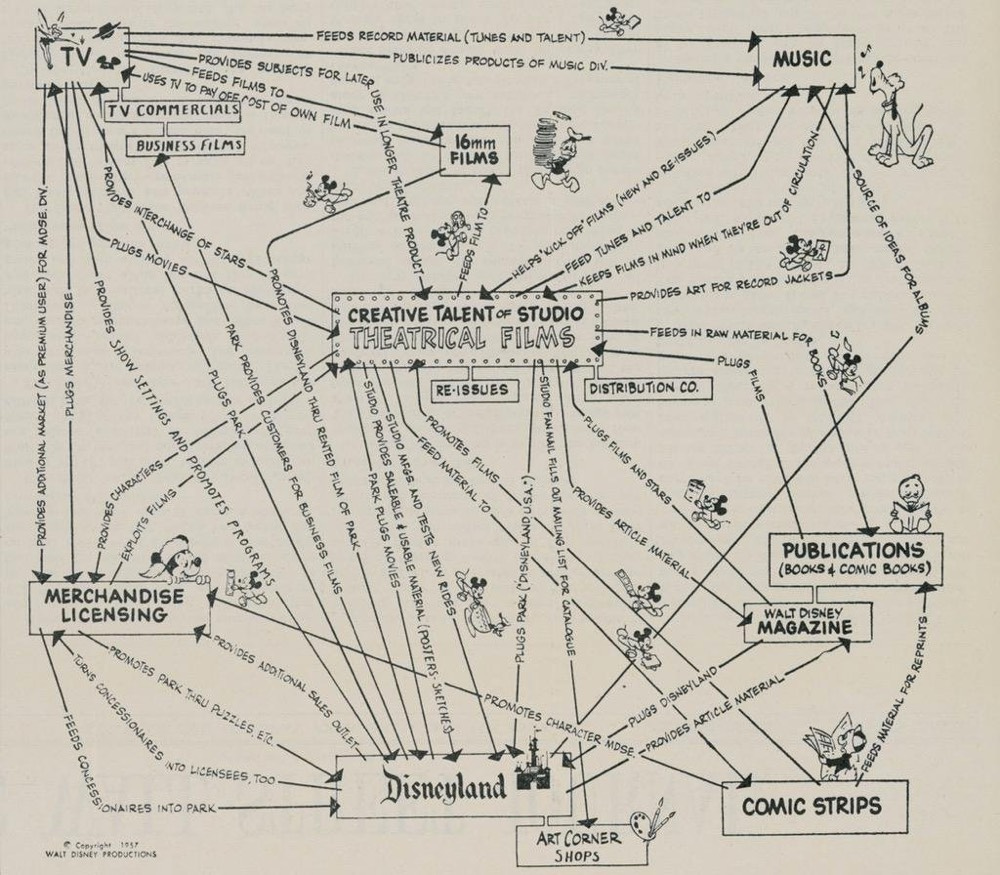

Over the past ~15 years, Disney has acquired Marvel, Lucasfilm, Pixar, Hulu, and Fox for nearly ~$100B. These acquisitions have helped Disney own more IP rights. With those rights, they can generate revenue from content, merchandise, and theme parks.

At the center, of course, are the Disney Studios, and rightly so. Not only does differentiated content drive movie theater revenue, it creates the universes and characters that earn TV licensing revenue, music recording revenue, and merchandise sales.

What has always made Disney unique, though, is Disneyland: there the differentiated content comes to life, and, given the lack of an arrow, I suspect not even Walt Disney himself appreciated the extent to which theme parks and the connection with the customer they engendered drive the rest of the business. ‘Disney’ is just as much of a brand as it Mickey Mouse or Buzz Lightyear, with stores, a cable channel, and a reason to watch a movie even if you know nothing about it.

- Ben Thompson (source)

Yuga Labs is taking a page from Disney and building its own media empire. Like Disney, Yuga is creating their own universes (i.e. metaverse) using their own characters (i.e. BYAC/Cryptopunk NFTs) that could earn revenue through licensing, merchandise sales, and more.

I can see a world where Yuga works directly with theme parks to have their own branded experiences. Or the Disneyland of the future may be visited through virtual/gaming interfaces.

Disney and other traditional media players will look at this acquisition for insight on how they can enter into the NFT space. This acquisition will also perk up the ears of web2 players. Visa acquired one Cryptopunk last year. Will we see corporations acquire an entire collection? Could media players like Netflix, HBO, and Disney+ plus look to acquire NFT rights to incorporate them into their content? Let’s see.

OpenSea Killer

OpenSea is the largest NFT platform today ($23B Annual Transaction Volume). Although, over the past year they have competitive forces from LooksRare, Magic Eden, NBA Top Shop, and others. Experts believe that there will be a move away from large marketplaces to either…

Platforms for specific use cases (e.g. art, music, real estate, etc) and/or

A company selling their own NFTs themselves (e.g. Axie Infinity, Stepn, etc).

Today you can only buy Cryptopunks on their website. With this acquisition, Yuga Labs may create their own NFT marketplace. New fast-growing projects may want to list there for lower fees & higher prestige. Being listed on an NFT marketplace that has the top collections may be seen as the best place to be.

5% of OpenSea sales come from Bored Ape collections today. Bored Apes potentially moving off of their platform would have a big impact on their transaction volume.

Centralization of Power

For all of the talk of decentralization, with this recent acquisition, Yuga Labs now accounts for 25% of NFT transactions volume on Ethereum today.

Like many of the acquisitions within the crypto space (e.g. Coinbase), we may look back on this in the next decade and wonder why it wasn’t subject to antitrust scrutiny.

Additional Resources

That does it for this week of Web3 Wednesdays.

Till next time,

Jay 💕